The Prince Albert II of Monaco Foundation and Monaco Asset Management officialise the first investment of the ReOcean Fund

Press release

Initiative

The Prince Albert II of Monaco Foundation and Monaco Asset Management have announced NatureMetrics as the first company entering the ReOcean Fund’s portfolio.

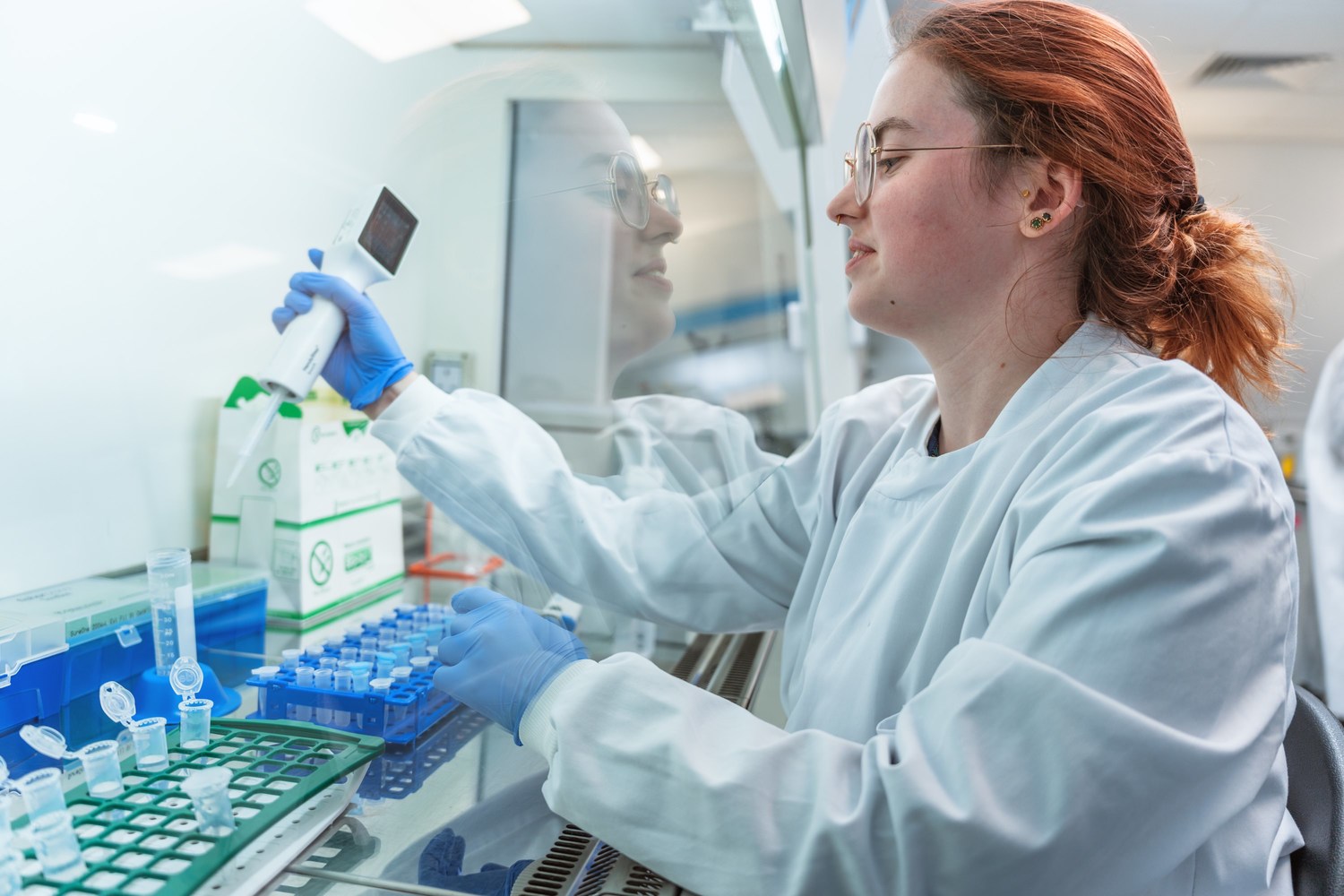

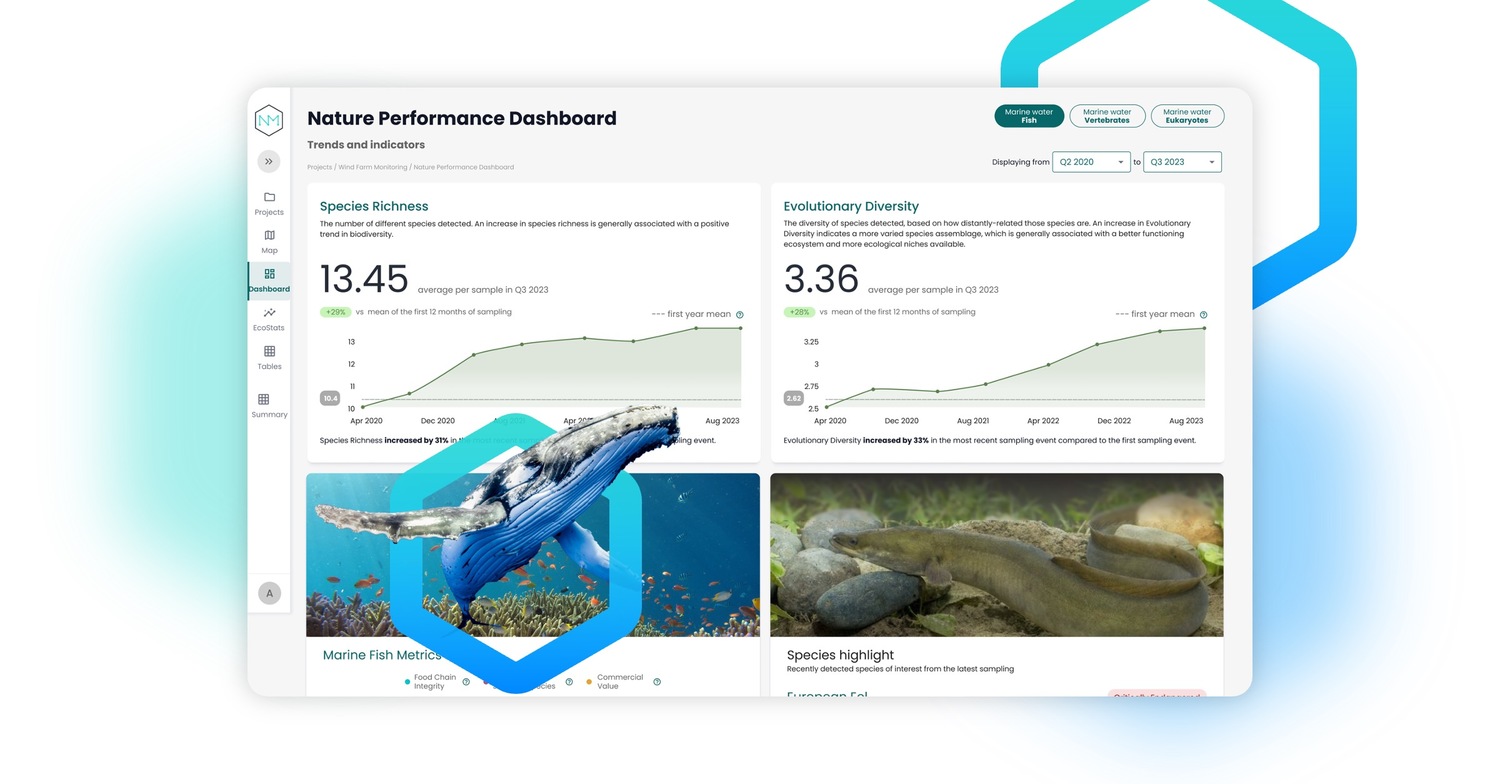

NatureMatrics is a world leader deploying cutting-edge technology to generate large-scale biodiversity information using environmental DNA, Earth observation, advanced data science and Artificial Intelligence. By transforming the way companies report on their impact on nature, providing both a scalable solution to biodiversity monitoring and a solution to new nature reporting commitments, NatureMetrics meets the objective of the ReOcean Fund to support ocean data and ocean intelligence.

“NatureMetrics is revolutionising biodiversity data, by turning insights into actionable strategies that align economic growth with environmental and ocean resilience. This innovation drives value creation while setting a new benchmark for embedding ocean health into business decisions – a natural fit for the ReOcean Fund’s mission to transform the blue economy.” Olivier Wenden, Vice-Chairman and CEO of the Prince Albert II of Monaco Foundation.

“With a $1.5 trillion direct contribution to the global economy, ocean health is fundamental to the sustainable future of our planet. Yet, as ocean biodiversity declines, we are running out of time to ensure its protection. Monitoring ocean health effectively must no longer be a barrier to its preservation and the responsible use of marine resources. The application of NatureMetrics’ technology in supporting ocean regeneration offers a transformative solution. This new funding empowers us to scale our efforts and provide organizations with the tools they need to drive data-driven decisions and meaningful action. ReOcean's commitment to catalyzing change makes them the ideal partner to accelerate our impact at scale." Dimple Patel, CEO of NatureMetrics.

This milestone marks the start of the fund investment phase into innovative companies from series A & B, in 5 key sectors aligned with the SDG 14 (Life Below Water): solutions to plastic pollution - healthy, regenerative and equitable blue food – green shipping and yachting – restoration and protection – ocean data.

Currently half-way to its 100M€ target, ReOcean will continue, in 2025, to mobilise capital in favor of the next generation of ocean innovations. 19 investors have already put their trust in the strategy of the fund as the Monaco Government.